At Stone Bridge Asset Management, we believe there's nothing better than a face-to-face meeting to get to know someone. Our journey with you starts with a conversation about your history, your family, your goals, and dreams. Understanding you is the foundation of our work, whether it's managing your portfolio or helping you plan for retirement and beyond. We pride ourselves on being more than just your money managers.

Are you looking for a team captain who can help you make the most of your resources?

Investments

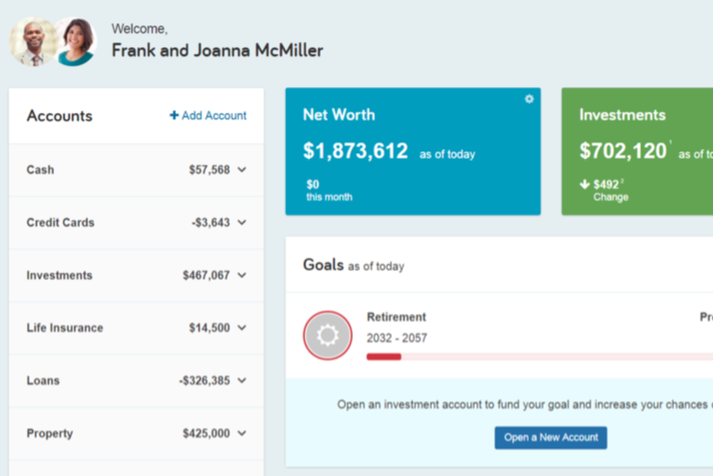

Our experienced team works closely with you to understand your financial goals and risk tolerance, crafting personalized strategies that aim to maximize returns while minimizing risks. With our proactive approach, we monitor market trends and adjust your portfolio to keep it aligned with your objectives. We believe in transparent communication, focused on keeping you informed and confident in your investment decisions. Let us help you build a robust financial foundation for the future.

Financial Coaching

Navigating the complexities of financial planning can be daunting. Our financial coaching services are designed to provide you with the guidance and strategies you need to achieve your financial goals. Whether you’re planning for a comfortable retirement, ensuring a smooth business transition, or maximizing your philanthropic impact, our personalized coaching will empower you to make informed decisions.

How We Work

Choosing a professional asset management firm is a deeply personal decision. It's about more than money; it's about building a relationship. We believe in creating a good fit between client and firm, ensuring a clear understanding of expectations and goals. We help you formulate achievable goals and set up strategies to meet them, offering conservative investment philosophies and thoughtful advice.

What's in a name?

A name is everything. It's your identity, telling everyone what you are all about.

Stone Bridge Asset Management takes its name from the Charles Bridge in the center of historic Prague, Czech Republic. The Charles Bridge (seen in the background) has adorned the Prague landscape for over 600 years, and has also been called the "Stone Bridge". it was built to last, and despite wars, floods, political upheaval, and the like, it has been providing its critical service reliably throughout the years. Beyond its reliability, the Charles Bridge is also known for its architectural beauty--it is a place where couples like to stroll on a pleasant spring day. We aim to be as successful as the "Stone Bridge" in combining lasting, reliable solutions with a relationship that our clients enjoy. Whatever your personal journey, Stone Bridge is here to take you across the financial divide.

This old Stone Bridge symbolizes what we strive to be for our clients: our clients' most valuable asset.

Sound Smart at a Dinner Party

Want to learn more about retirement, social security, or estate strategies? Check out the wealth of resources that are available to you, in addition to our monthly "Notes from Stone Bridge".